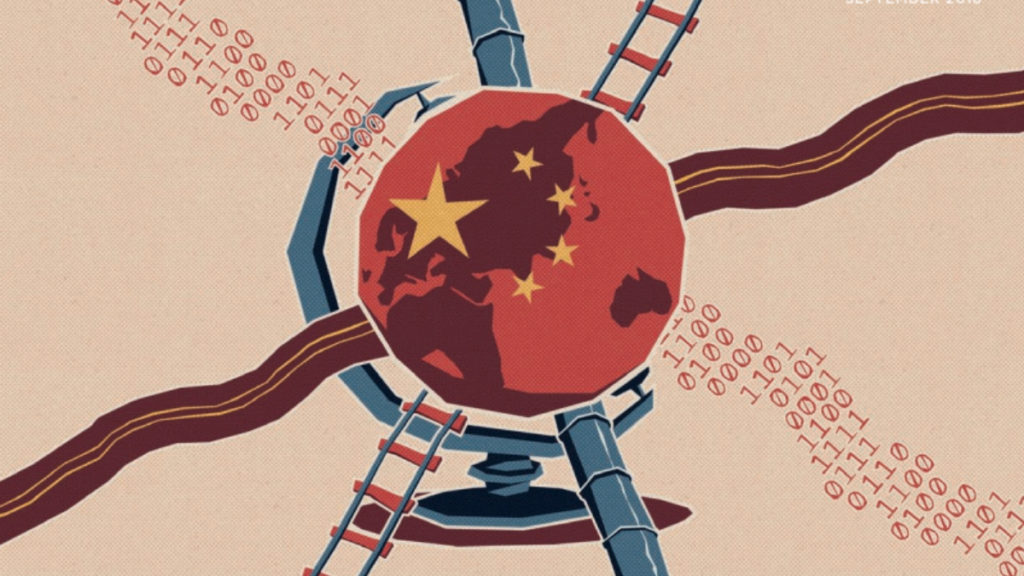

Where does the Silk Road lead? – China’s ambitions in Hungary and the region

Author: Engelbrecht Azurea. Cover photo: Trade Finance Global

Real danger or Western propaganda?

“It is very difficult to separate propaganda from reality: is it true that some countries are in a debt trap? This is true. Is it true that the Chinese are deliberately pushing the Silk Road countries into a debt trap, as the Americans claim? Well, that’s not true at all.” – Tamás Matura

According to Tamás Matura, Hungary is not threatened by a debt trap, because if the costs of the Budapest-Belgrade railway and the possible arrival of Fudan are added together, the amount is still manageable for the size of the Hungarian economy. In some countries in the Western Balkans, Chinese projects account for 20-40% of GDP, but in our country they are only 2-3%.

However, this does not mean that the Budapest-Belgrade railway line is a good deal for Hungary. “We have been talking about it for seven or eight years, but I have yet to see a serious analysis that says it is the investment of the century,” says Tamás Matura.

China is not deliberately pushing other countries into debt traps either. There are some embarrassing cases, according to Tamás Matura, such as Sri Lanka and Malaysia having to hand over ports, but the failure rate is not much worse than at the IMF or the World Bank.

“The Chinese sign contracts that secure their side up to one hundred thousand percent, and they don’t really care whether the government that signs it does so responsibly,” says Tamás Matura.

Western banks and organisations, however, do their due diligence, look at the environmental impact, sustainability, feasibility and potential risks, and only then do they lend.

China also needs to change its practices, says Tamás Matura. “The Chinese have started to cut back on their own lending because they have realised that if there are too many defaulted or non-performing loans, it hurts their own financial system after a while. They are slowly realising that the Western standards followed by the big Western institutions and banks are not the way they are by accident.”