For Current Students

GoodToKnow – Thesis Submission

Deadlines

Theses may only be submitted electronically.

As we have informed you before, the deadline of thesis submissions has been modified as follows:

The deadlines for submission are as follows:

- For the following undergraduate programmes: 18.05.2020 (Monday) 02:00 pm:

Business and Management, Business Informatics, Commerce and Marketing, Rural Development Engineering, Applied Economics, Economic and Financial Mathematical Analysis, Political Science.

- For the following undergraduate programmes: 18.05.2020 (Monday) 03:00 pm:

Finance and Accounting, Tourism and Catering, Human Resources, Communication and Media Science, International Relations, Sociology

- For the undergraduate programme in International Business Economics: 18.05.2020 (Monday) 03:00 – in Neptun!

- For graduate programmes: 19.05.2020 (Tuesday) 03:00 pm

- For postgraduate specialist programmes: 20.05. 2020 (Wednesday) 03:00 pm

For each programme, the submission platform shall be Moodle, except for the International Business Economics undergraduate programme where it shall be Neptun. The theses shall be uploaded accompanied by the Urkund plagiarism report. The anti-plagiarism regulations as well as information on the use of the Urkund software are available on Neptun’s landing page.

Important documents

I. Content requirement

1. The title of the dissertation

– A concise expression of the content and message of the dissertation,

– if the title is not clear in relation to the subject, then a explanatory or alternative subtitle is required;

– implies the central topic(s) of the dissertation.

2. Introduction and motivation

– more detailed description of the topic of the dissertation then given in the title;

– justification of the topic selection;

– short description of the process and logic of the reasoning;

– short (maximum 2 to 5 pages long).

3. Review of literature

– summary of the conclusions of research prepared in similar area;

– the specification of the research methodology (if the author in the course of the research used a more substantial methodology apparatus);

4. The explanation of the main topic of the dissertation

– the description and evaluation of the problem selected with the assistance of the concepts and models introduced in the introduction of theory section

– consistent use of the concepts and models introduced in the theory section of the dissertation;

– contains conclusions supported by well founded arguments, facts and reasoning;

– objectivity in the description of the issue/situation of the examination / research is critical;

– the author’s personal opinion is included and it can be clearly differentiated form the position evaluation and solutions and opinions of other co-operating persons;

– combines the experience with the models discussed in theory introduction section with the earlier empirical examinations, and the described hypotheses;

– its length (if correctly constructed) is at least half the length of the dissertation;

5. Summary

– the summary of the results/conclusions of the dissertation,

– defines direction for further examination based on the achieved results and topics which were not discussed but are closely connected.

6. References

– summary which assists in the checking of the references / citations in the dissertation;

– the bibliography must meet strict requirements, these are detailed in the formal requirement section of this Regulation.

7. Annexes (not mandatory)

– with emphasis: introduction of the methodology documentation (questioner, interview outline, calculations etc., disclosure of);

– the display of diagrams, tables, documents etc., which are necessary to understand the dissertation but, at the same time, they do not have a close connection to any of the chapters or sub chapters of the dissertation; or there are are too many or too many details and would make the relevant chapter difficult to ready;

– the display of diagrams, tables, documents etc., which may have a close connection to one given chapter/sub-chapter of the dissertation, their form (e.g. A3) and or due to their length (2 or more pages) they are to be attached as annexes;

– its function is clear and unquestionable; the accusation of deliberately enclosing it to increase the number of pages can not be raised at all;

– numbered, titled, and it is also included in the table of contents;

– it may only be more than 15% of the actual dissertation, only if well justified.

– the above discussed main parts are unidentifiable in the dissertation;

– the consistency and harmony between the main sections of the dissertation is seriously damaged (e.g. the applicant only discusses the topic indicated in the title of the dissertation to a very insignificant extent or the concepts and models described in the Introduction of Theory section of the dissertation are only used marginally in the discussion aimed at the specific subject of the dissertation);

– the dissertation contains sections longer than 1 paragraph (3 to 4 sentences) copied verbatim or in a form closely resembling verbatim from a foreign source/work of another, without crediting (properly citing) the source in the body of the text where appropriate and in the bibliography (hereinafter “Plagiarism”).

– the dissertation, continually through several pages, is based only on one foreign source (even if the source is properly cited / credited to the actual author in the body of the text where appropriate and in the bibliography);

– the basic topics of the dissertation contains a series of errors either in the theoretical or empirical part;

– the length of the dissertation considerably differs from the expectations;

– the spelling, grammatical, stylistic and/or editing errors in the dissertation are disturbing and may even endanger the comprehension of the dissertation.

II. Formal requirements

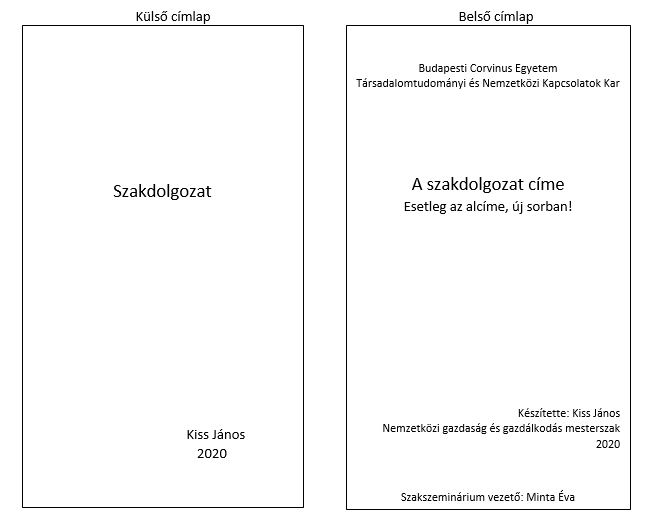

1. Cover page

2. Table of Contents , List of Diagrams , List of Tables

– The chapters and sub-chapters must be numbered (with Arabic numerals) the depth of this depends on the nature of the dissertation. Condition of separation within the sub-chapters, is that it must contain several subsections. It is a requirement relating to the table of contents that it must be laid out / outlined only up to three different levels (for example 2.3.1. subsection).

3. The formal requirement relating to the body of the text

– The thesis/diploma work must be printed on one side of the paper. [8]

– The pages must have a 2-2.5 centimetre margin on all sides (upper, lower right and left), furthermore on the left side there must be 1 centimetre gutter margin.

– The letter type of the thesis/diploma work is not specified, any legible traditional type may be used. The idea font size is Times New Roman 12. [9]

– The thesis / diploma work is prepared with a 1.5 line spacing, which is approximately 30 to 35 lines per page. [10]

– To ensure clarity, the text should be divided into paragraphs.

4. References

– The source of those conclusions (sentences, paragraphs and data) of the thesis/diploma work which are used by the author and are based on the works of others must be clearly referenced / indicated. [11]

– The reference /citation of the other source must appear at the end of the relevant text in parentheses including the last name of the author and the date of the publication (Author 1, Last name – Author 2, Last name, 2002). In case of reference to the works of three or more authors, starting from the second reference in the text, after the naming of the first author the reference may be abbreviated by the use of “et. Al.” abbreviation (Author 1, Last name et. al., 2002). In case of two publication of the same author in the same year after the year the letter “a” or “b” must be written to differentiate between the publications. (Author, last name, (2002a)). Optionally the reference / citation may, instead of the body of the text (in the same form), be indicated on the bottom of the given page in footnotes.

– In case of verbatim quotations, listing, translation, tables or diagrams the exact page number must also be provided (Author’s Last name, 2002, page 85).

5. Bibliography

– The bibliography is the detailed specification of those professional academic publications and studies, which are referenced in the body of the text of the dissertation, including here the diagrams and tables included in the body of the text as well as statistical data and estimations / forecasts and the content of the attachments as well. (There is no need to indicate publications not referenced in the dissertation and used only for background reading) The bibliography may only contain works to which there is actual reference in the main text of the dissertation.

– The authors of the referenced works must be listed in alphabetical order in the bibliography.

– When indicating the works the name of the author must indicated first (in case of a Hungarian author, the full name of the author, in case of a foreign author only the last name, and the first letter of the first name), directly thereafter the year of the publication must be indicated. The address comes after the colon, the name and location of the publication, in case of academic/professional publications the year and the page number. (Samples can be found in Annex 1/A.2.1/C.) [12]

– In case of works whose authors are unknown the “anonymous” must be indicated in the place where the author’s name should be. However, the student shall pursue to identify that is to learn the name of the author or editor of the publication (in the latter case the the editor (ed.) abbreviation must be indicated after the name).

– Th author and address are necessary even in case of internet sources, in lack of this the web page or he name of the portal can be indicated. The URL internet address and the date of download must also be indicated. In case of reference to internet sources the referred pages must be downloaded to ensure that the person heading up the seminars or the reviewers can find the referenced information.

– In certain cases it might be useful, depending on the frequency of use of such words, to supplement the dissertation and prepare a glossary/definitions of words consisting of the special technical expressions and or abbreviation. This should be placed before the bibliography.

Ferenc Bel – János Derek – Béla Ügyes (1997): The good economic policy in light of the figures Economics and Law Publishing House, Budapest.

Elemér Buda (1999a): The effect bird migration on the competitiveness of companies. Technical information ornithological-12, Vol. 3rd issue March

Elemér Buda (1999a): Birds of a feather? The role of parallels in economic analysis Economics and Law Publishing House, Budapest.

Vetkatraman, N. (1991): IT-induced Business Reconfiguration. In: Scott Monton, M. S. (ed.): Corporation of the 1990s: Information Technology and Organizational Transformation. Oxford University Press, New York.

Weicher, M. – Chu, W. W. – Lin, W. Ch. – Le, V. – Yu, D. (1995): Business Process Re-engineering. Analysis and Recommendations. http://www.netlib.com/bpr1.htm#isit, 1996. február 23-án.

Wernerfelt, B. (1984): The Resource Based View of the Firm.Strategic Management Journal, Vol. 5. No. 2, pp. 171-180.

Topics for Thesis Seminar

Zoltán ÁDÁM

· The Political Economy of Populism – with a View on Europe and Other Parts of the World

Selected readings:

Acemoglu, D., Egorov G, and Sonin, K. (2013). “A Political Theory of Populism”. The Quarterly Journal of Economics, 771-805.

Acemoglu, D. and Robinson, J. A. (2000). “Why Did the West Extend the Franchise? Democracy, Inequality, and Growth in Historical Perspective”. The Quarterly Journal of Economics, November.

Dornbusch, R. and S. Edwards (1989): ‘Macroeconomic Populism in Latin America’ National Bureau of Economic Research (Cambridge, MA) Working Paper No. 2986.

Kornai, J. (2015), ‘Hungary’s U-turn’ Capitalism and Society, Vol. 10. Issue 1. Article 2. (http://capitalism.columbia.edu/journal/10/2.)

Mazzuca, S. L. (2013), ‘The Rise of Rentier Populism’ Journal of Democracy, Vol. 24. No. 2. April, 108-122.

Mudde, C. (2007), Populist Radical Parties in Europe. New York: Cambridge University Press

Pirro, A. L. P. (2015), The Populist Radical Right in Central and Eastern Europe. London: Routledge

· The Political Economy of Post-Socialist Transformation: Performance of Hungary and other Central and Eastern European Countries

Selected readings:

Benczes, István. 2011. „Market reform and fiscal laxity in Communist and post-Communist Hungary. A path-dependent approach”. International Journal of Emerging Markets. Vol. 6, No. 2, pp. 118-131.

Djankov, Simeon – Murrel, Peter. 2002. „Enterprise Restructuring in Transition. A Quantitative Survey”. Journal of Economic Literature, Vol. 40, No. 3, pp. 739-92 (September).

Gelbach, Scott – Malesky, Edmund J. 2010. „The Contribution of Veto Players to Economic Reform”. The Journal of Politics, Vol. 72, No 4 (September), pp. 957-975.

Inglot, Tomasz, Dorottya Szikra, and Cristina Raţ. 2012. “Reforming Post-Communist Welfare States.” Problems of Post-Communism, Vol 59, No. 6, pp. 27–49

Kornai, János. 1992. The Socialist System: The Political Economy of Communism. Princeton: Princeton University Press, 1992

Kornai, János. 1994. “Transformational Recession: The Main Causes”. Journal of Comparative Economics, Vol. 19, No. 3, pp. 39-63.

Roland, Gérard 2002. „The Political Economy of Transition”. Journal of Economic Perspectives, Vol. 16, No. 1 (Winter), pp. 29-50.

· What is the EU Good For? Comparative Economics of European Integration in Light of the Crisis

Selected readings:

Baldwin, Richard –Wyplosz, Charles (2015): The Economics of European Integration, McGraw-Hill, 5th ed. (Earlier editions can be also used.)

Baldwin, Richard – Giavazzi, Francesco (eds.) (2016): How to fix Europe’s monetary union: Views of leading economists. A VoxEU.org eBook, CEPR Press. Downloadable at voxeu.org/epubs

Feldstein, Martin (1997): “The Political Economy of the European Economic and Monetary Union: Political Sources of an Economic Liability”. NBER Working Paper No. 6150 (August 1997). Downloadable at nber.org/papers/w6150.

Lane, Philip R (2012): “The European Sovereign Debt Crisis”. Journal of Economic Perspectives, 26(3), 49-67. pubs.aeaweb.org/doi/pdfplus/10.1257/jep.26.3.49

Sadeh, Tal – Verdun, Amy (2009): “Explaining Europe’s Monetary Union: A Survey of the Literature”. International Studies Review, 2009/11, 277-301

Sinn, Hans-Werner (2014): The Euro Trap. On Bursting Bubbles, Budgets, and Beliefs. Oxford University Press.

Varoufakis, Yanis – Holland, Stuart – Galbraith, James K. (2013): A modest proposal for resolving the Eurozone crisis, Version 4.0. Downloadable at https://varoufakis.files.wordpress.com/2013/07/a-modest-proposal-for-resolving-the-eurozone-crisis-version-4-0-final1.pdf

Dániel DEÁK

Regulatory and tax competition: streamlining business law or taking a fiscal war?

Upon regulatory and tax competition, a focus can be put on the sovereignty of the nation state, and on the territorial scope of legislation. In this instance, the destination-based regulatory power emerges. In line with, an in contrast to, it, harmonisation would remove administrative barriers and promote market mechanisms. The concepts of capital export and import neutrality are associated with the extension of the fiscal policy ideal of tax neutrality across the border while tax competition – that is, a state that is engaged in interference with the market behaviour – cannot be complied with the benchmark of neutrality. Arguably, as regulatory & tax competition badly affects the integrity of a jurisdiction, it causes harm to all market participants. Arguments can also be delivered, however, in favour of regulatory and tax competition. In a changing world of globalism, there has been increasing room for legal and tax planning for those who are mobile, due to regulatory competition. Under these circumstances, the state does not only make compulsory demands on its subjects, but it increasingly acts as a recruiter to solicit investments as well as residents from the global arena.

– Even Avi-Yonah, ”Globalization, tax competition, and the fiscal crisis of the welfare state“, Harvard Law Review, Vol. 113, (1999-2000) at 1573

– Reuven Avi-Yonah, “International tax as international law“, New York Tax Law Review, Vol. 57, 2003-2004, at 483

– Nicholas Shaxson and John Christensen, ”Tax competitiveness—a dangerous obsession“, in: Thomas Pogge, Krishen Mehta (eds.), Global tax fairness, Oxford University Press, Oxford, 2016

– Tsilly Dagan, ”The tragic choices of tax policy in a globalized economy“, Yariv Brauner and Miranda Stewart (eds), Tax, Law and Development, Edward Elgar Cheltenham, UK + Northampton, MA, 2013

– Yariv Brauner, ”The future of tax incentives for developing countries“, Yariv Brauner and Miranda Stewart (eds), Tax, Law and Development, Edward Elgar Cheltenham, UK + Northampton, MA, 2013

Spirituality, law and business

In a study paper on the relationship between spirituality and law, various approaches to this topic can be evaluated to explore more in detail the interconnection between spirituality and law. On the one hand, one can count on the fact that an uncritical approach to economic growth and anthropomorphic ethics is currently dominating, and community interventions are commonly judged by their success without placing sufficient emphasis on mutual understanding, solidarity and equality. On the other hand, on can realise new approaches that spur to remove boundaries between spirituality and law. The description of current legal problems can be complemented by referring to the good practices of spiritually oriented legal projects. In particular, one can concentrate on the developments of legal innovation with a view to tracing the impact of spirituality on legal and business practices. The issues that can be discussed in this respect are, e.g.: extension of rights to non-human beings, on the one hand, and the various grades of evolving legal regulation and substantiating rights through care, morality and legality, on the other one.

– Bouckaert, L. (2007): Spirituality in Economics. In: Bouckaert, L. – Zsolnai, L. (eds): Spirituality as a Public Good. Antwerpen & Apeldoorn: Garant

– Brian Barry (1999), Sustainability and intergenerational justice, in: Andrew Dobson (ed.), Fairness and futurity; Essays on environmental sustainability and social justice, New York: Oxford University Press

– Peter Gabel (May 2014), The spiritual dimension of social justice, Journal of Legal Education, Vol. 63, No. 4, p. 673

– Axel Gosseries and Lukas H. Meyer (2009), Introduction – Intergenerational justice and its challenges, Axel Gosseries and Lukas H. Meyer (eds), Intergenerational justice, Oxford: Oxford University Press

– Herbert L.A. Hart (1961), The concept of law, Oxford: Clarendon Law Series, Oxford University Press

– Friedrich A. Hayek (1976), Law, legislation and liberty; A new statement of the liberal principles of justice and political economy; Vol. 2: The mirage of social justice, London: Routledge & Keagan Paul

– Richard P. Hiskes (2008), The human right to a green future; Environmental rights and intergenerational justice, Cambridge: Cambridge University Press

– Hans Jonas (1984), The imperative of responsibility (In search of an ethics for the technological age), Chicago, IL: University of Chicago Press

– Martin Luther King, Jr. (1986), Love, law and civil disobedience, A testament of hope; The essential writings and speeches of Martin Luther King, Jr., Ed. by James M. Washington, San Francisco: Harper and Row

– Lukas Meyer (2016), Intergenerational justice, The Stanford Encyclopedia of Philosophy (Summer 2016 Edition), Edward N. Zalta (ed.), URL =

– John Rawls (2001), Justice as fairness; A restatement, Ed. by Erin Kelly, Cambridge, MA: Belknap Press of Harvard University Press

– Tom Regan (2003), Animal rights, human wrongs; An introduction to moral philosophy, Lanham, MD: Rowman & Littlefield

– William David Ross (1930), The right and the good, Oxford: Clarendon

– Kristin Shrader-Frechette (2002), Environmental justice; creating equity, reclaiming democracy, Oxford: Oxford University Press

– Marjorie A. Silver (2016), Transforming justice, lawyers and the practice of law, Scholarly Works, Touro Law Center, New York

– Peter Singer (2002), Animal liberation, „Preface to the 1975 edition“, New York: Harper Collins

– Malcolm B.E. Smith (1996), The duty to obey the law, in: D. Patterson (ed.), A companion to philosophy of law and legal theory, Oxford: Blackwell

– Christopher D. Stone (1972), Should trees have standing? – Toward legal rights for natural objects, Southern California Law Review, Vol. 45

– Hendrik Ph. Visser ’T Hooft (1999), Justice to future generations and the environment, Dordrecht: Springer, Kluwer

– James W. Vander Zanden (1987), Social psychology, New York: McGraw-Hill

Hungary since 2010: Rule of law or rule by law?

It seems to be timely to discuss how the law is made under the so-called unorthodoxy, and what are the special features of such unorthodox legal policy. The alleged unorthodoxy may challenge equality in law and before the law, and is critical towards the movements of mass democracy. It also raises doubts on the operability of the rule of law, relying on personal skills, or loyalty, rather than on impersonal mechanisms arising from checks and balances as developed by the division of political power. A rule by law system suggests that the law is subordinated to ideological and political considerations, and lacks autonomy in its generation. Besides, for lack of legal suppositions, legislation suffers from casuistry and regulatory capture. These developments may compromise not only democracy, but also the business life that suffers from the lack of transparency and market access.

– Bourdieu, P. (1989): Social Space and Symbolic Power. In: McQuarie, D. (ed.): Readings in Con- temporary Sociological Theory: From Modernity to Post-modernity. Englewood Cliffs: Prentice Hall

– Braithwaite, J. (2002): Rules and Principles: A Theory of Legal Certainty. Australian Journal of Le- gal Philosophy 27: 47–82

– Bruni, L. Zamagni, S. (2007): Civil Economy; Efficiency, Equity, Public Happiness. Bern: Peter Lang

– Carothers, T. (1998): The Rule of Law Revival. Foreign Affairs 77(2)

– Dworkin, R. (1986): Law’s Empire. Cambridge: Harvard University Press

– Freud, S. (1921): Massenpsychologie und Ich-Analyse. Wien: Internationaler Psychoanalytischer

Verlag

– Fuller, L. L. (1964): The Morality of Law. New Haven and London: Yale University Press

– Gribnau, H. (2007): Soft Law and Taxation: The Case of the Netherlands. Legisprudence 1(3): 291–326

– Habermas, J. (1995): What Does a Crisis Mean Today? Legitimation Problems in Late Capitalism. In: McQuarie, D. (ed.): Readings in Contemporary Sociological Theory: From Modernity to Post-modernity. Englewood Cliffs: Prentice Hall

– Halmai, G. – Scheppele, K. L. (eds) (2013): Amicus Brief for the Venice Commission on the Fourth Amendment to the Fundamental Law of Hungary. April

– Harlow, C. (2006): Global Administrative Law: The Quest for Principles and Values. European Journal of International Law 17(1): 190–192

– Hart, H. L. A. (1961): The Concept of Law. Oxford: Oxford University Press

– Hayek, F. A. von (1960): The Constitution of Liberty. Chicago: University of Chicago Press

– Hayek, F. A. von (1976): Law, Legislation and Liberty. Vol. 2: The Mirage of Social Justice.

Routledge & Keagan Paul

– Hayek, F. A. von (1974): Lecture to the Memory of Alfred Nobel. 11 December

– Kelsen, H. (1945): General Theory of Law and State. Cambridge: Harvard University Press. King, M. L. (1963): Letter from Birmingham Jail. The Atlantic 212(2): 78–88

– Laclau, E. (2005): Populism: What’s in a Name? In: Panizza, F. (ed.): Populism and the Mirror of Democracy. London: Verso

– Leibholz, G. (1977): Der Rechtsstaat und die Freiheit des Individuums. In: Meyers enzyklo-

pädisches Lexikon, Band 19. Mannheim: Bibliographisches Institut

– Maxeiner, J. R. (2006–2007): Legal Certainty: A European Alternative to American Legal Indeterminacy? Tulane Journal Int’l & Comparative Law 15

– Neumann, E. (1949): Tiefenpsychologie und neue Ethik. Zürich: Rascher

– Ost, F. (1988): Between Order and Disorder: The Game of Law. In: Teubner, G. (ed.): Autopoietic Law: A New Approach to Law and Society. Berlin and New York: W. de Gruyter

– Paunio, E. (2009): ”Beyond Predictability – Reflections on Legal Certainty and the Discourse Theory of Law in the EU Legal Order“. German Law Journal 10(11): 1469

– Popelier, P. (2000): ”Legal Certainty and Principles of Proper Law Making“. European Journal of Law Reform 2(3): 321

– Pound, R. (1942): Administrative Law; Its Growth, Procedure and Significance. Pittsburgh: University of Pittsburgh Press

– Radbruch, G. (1946): Gesetzliches Unrecht und übergesetzliches Recht. Süddeutsche Juristenzeitung 1: 107–108

– Rumble, W. E. (1961): Jerome Frank and his Critics: Certainty and Fantasy in the Judicial Process. Journal of Public Law 10: 125–138

– Scalia, A. (1989): The Rule of Law as a Law of Rules. The University of Chicago Law Review 56(4):1175–1188

– Schauer, F. (2003): The Convergence of Rules and Standards. New Zealand Law Review 2003: 303–328

– Summers, R. S. (1999): The Principles of the Rule of Law. Notre Dame Law Review 74: 1691–1712. Society and Economy 36 (2014)

– Tamanaha, B. Z. (2004): On the Rule of Law; History, Politics, Theory. Cambridge: Cambridge University Press

– Teubner, G. (1983): ”Substantive and Reflexive Elements in Modern Law“. Law and Society 17(2): 257

– Vörös, I. (2013): Vázlat az alapvető jogok természetéről az Alaptörvény negyedik és ötödik módosítása után [Az AB döntése, a Velencei Bizottság és az Európai Parlament állásfoglalásai] [Outlines on the nature of fundamental rights after the Fourth and Fifth Amendment of the Fundamental Law (Decision of the Constitutional Court, standpoints of the Venice Commission and the European Parliament)]. Fundamentum 17(3): 53–65

– Weber, M. (1922): Wirtschaft und Gesellschaft. Tübingen: Mohr Siebeck

Tax coordination across the border

It is possible to study the legal order of obliging someone to pay tax and the way, in which tax liability can be enforced not only with regard to the legal order of the nation state, but also in terms of international relations. The law normally appears as a national system. Such an approach to it ignores the reality of economic activity, however. Comparative tax law has been proliferated, and international taxation has started being recognised as international law. International tax law can be traced back in particular to the various OECD model treaties, and there are all the more comprehensive commentaries on them as well. Other international agencies, like IMF or the European Comission have also greatly contributed to the development of the culture of international tax law.

A key to development of economy is a break out of a fragmented world. Citizens and their enterprises that enter the international arena have been successful in creating for themselves from time to time a legal order for their own use, which can be mutually recognised by affected parties, and which can operate as the quasi-legal source of their commercial relationships. This type of emerging law is also extended to the relationships with the tax authorities. In these instances, taxpayers and the tax authorities may enter with each other into contractual relationships with a view to both better enforcing tax claims and enhancing effectiveness in the protection of the taxpayers’ rights. All this suggests that the horizontal structures of the enforcement of tax claims have been proliferated.

– I. Wallerstein, “The rise and future demise of the capitalist world system: concepts for comparative analysis“, I. Wallerstein, The capitalist world-economy. Cambridge University Press, Cambridge, 1980. pp. 5-6, 17-19, 34; The modern world-system, I; Capitalist agriculture and the origins of the European world-economy in the sixteenth century, Academic Press, New York, San Francisco, London, 1974

– Reuven Avi-Yonah, “International tax as international law“, New York Tax Law Review, Vol. 57, 2003-2004, at 483

– Even Avi-Yonah, ”Globalization, tax competition, and the fiscal crisis of the welfare state“, Harvard Law Review, Vol. 113, (1999-2000) at 1573

– Pasquale Pistone, “Coordinating the action of regional and global players during the shift from bilateralism to multilateralism in international tax law”, World Tax Journal, Vol. 6, February 2014

– María Teresa Soler Roch, “Forum: Tax administration versus taxpayer – A new deal?“, World Tax Journal, Vol. 4, No. 3, October 2012

– “OECD Tax Intermediaries Study Working Paper 6 – The enhanced relationship“; OECD Tax Intermediaries Study, Paris, July 2007

Fiscal consolidation across the border

From the point of view of unitary taxation, the contradiction between legally independent entities and the major economic entity comprising smaller legal entities could be resolved. Building blocks for this are:

– a proposed approach treats the single unified multinational enterprise in the same way it is treated for financial reporting purposes;

– problems of transfer pricing, hybrid companies or hybrid finance could be eliminated;

– residence countries may be the jurisdictions where the headquarters of international company groups reside, from which the international company group is managed and controlled;

– source countries are not compelled to take part in tax competition where the residence countries would give credit for the source county tax; and

– the new system of unitary taxation could be introduced on a multilateral basis.

The re-launched CCCTB will be implemented in two steps:

– the Common Consolidated Corporate Tax Base (CCCTB) is a single set of rules to calculate companies’ taxable profits in the EU; and

– the consolidated taxable profits will be shared between the Member States, in which the group is active, using an apportionment formula.

– Reuven S. Avi-Yonah, ”Hanging together; A multilateral approach to taxing multinationals“, in: Thomas Pogge, Krishen Mehta (eds.), Global tax fairness, Oxford University Press, Oxford, 2016

– Yariv Brauner, ”The future of tax incentives for developing countries“, Yariv Brauner and Miranda Stewart (eds), Tax, Law and Development, Edward Elgar Cheltenham, UK + Northampton, MA, 2013

– Agúndez-García, Ana. 2006. The Delineation and Apportionment of an EU Consolidated Tax Base for multi-jurisdictional Corporate Income Taxation: a Review of Issues and Options. European Commission, Working Paper No. 9/2006

– Begg, Iain. 2011. An EU Tax – Overdue Reform or Federalist Fantasy? International Policy Analysis. Berlin: Friedrich-Ebert-Stiftung

– Bettendorf, Leon, Devereux, Michael P., van der Horst Albert, Loretz, Simon and de Mooij, Ruud A. 2010. ”Corporate tax harmonization in the EU“. Economic Policy. (63): 537–590

– Cobham, Alex and Loretz, Simon. 2014. ”International distribution of the corporate tax base: Impact of different apportionment factors under unitary taxation“. In: 70th Annual Congress of the International Institute of Public Finance. Lugano: Switzerland

– Devereux, Michael, P. and Loretz, Simon. 2008. ”Increased Efficiency through Consolidation and Formula Apportionment in the European Union?“ Oxford: Oxford University, Centre for Business Taxation. Working Paper No. 12

– Fuest, Clemens, Hemmelgam, Thomas and Ramb, Fred. 2007. ”How would the introduction of an EU-wide formula apportionment affect the distribution and size of the corporate tax base? An analysis based on German multinationals“. International Tax and Public Finance 14(5): 605-626

– Fuest, Clemens, Heinemann, Freidrich and Ungerer, Martin. 2015. „Reforming the Financing of the European Union: A Proposal“. Intereconomics 50(5): 288-293

– Heinemann, Friedrich, Mohl, Philipp and Osterloh, Steffen. 2008. Reform Options for the EU Own Resource System, Vol. 40, Heidelberg: Physica-Verlag

– McDaniel, Paul R. 1994. Formulary Taxation in the North American Free Trade Zone. Tax

Law Review 49(4): 691–744

– McLure, Charles E. 2008. Harmonizing corporate income taxes in the European

community: Rational and implications. Tax Policy and the Economy 22: 151–195

– Mintz, Jack. 2008. ”Europe slowly lurches to a common consolidated corporate tax base: Issues at stake“. In: Lang, M., et al. (eds.). A Common Consolidated Corporate Tax Base for Europe. Alemanha: Springer, 128–138

– Pethig, R., Wagener, A. 2003. Profit Tax Competition and Formula Apportionment. CESifo Working Paper. No. 1011

– Picciotto, Sol. 1992. International Business Taxation – A Study in the Internationalization of Business Regulation. London: Weidenfeld and Nicolson

– Weiner, Joann M. 1999. Using the Experience in the U.S. States to Evaluate Issues in Implementing Formula Apportionment at the International Level. U.S. Department of the Treasury, OTA Paper 83

– Weiner, Joann M and Mintz, Jack. 2002. ”An Exploration of Formula Apportionment in the European Union“. European Union 42(8): 346–351

Fundamental EU freedoms and market imperfections

In regard to a series of scenarios of the institutional development of the EU (populism, the Commission’s view, ECB-perspective, federalism, etc.), one can discuss the challenges of the EU legal order. Problems arise from the fact that Community law has been instrumentalised in a long process, that is, basic legal values – such as legal certainty – have been subject to the considerations of the fundamental EU freedoms. Functionalism and constitutionalism have spread over, and the integration through law has not necessarily been developed in line with the articulation of the policies of the MSs.

There is dubious legal basis for harmonisation in the instances as follows:

– Harmonisation measures like the proposed European-wide financial transaction tax are not designed to further free competition; on the contrary, they are to eliminate market imperfections. In this case, it is a problem, however, that there is no standard – like free competition –, to which new harmonisation measures could be compared.

– Article 113 TFEU is based on the bogus assumption that distortion could be caused by the unilateral measures of the public authorities of the Member States. Upon the innovation of the EU legislation, distortions do not arise from state intervention, but from the very nature of the operation of the internal market. However, there is no EU competence for obliging market participants to make a fair contribution, or for applying disincentives for speculative financial transactions or for transactions that contribute, e.g., to deepening the ecological crisis.

– Dennis Weber (ed.), Traditional and alternative routes to European tax integration; Primary law, secondary law, soft law, coordination, comitology and their relationship, IBFD, Amsterdam, 2010

– Talcott Parsons, The system of modern societies, Englewood Cliffs, NJ, Prentice-Hall, 1971

– Günther Teubner, “Introduction to autopoietic law“; in: G. Teubner (ed.): Autopoietic law: A new approach to law and society, Berlin, New York, 1988

– F.A. Hayek, Law, legislation and liberty; A new statement of the liberal principles of justice and political economy: Vol. 2: The mirage of social justice, Routledge & Keagan Paul, London, 1976

– John Rawls, „Outline of a decision procedure for ethics”, Philosophical Review, Vol. 66, 1957; Ken Kress, „Coherence”, in: D. Patterson (ed.), A companion to philosophy of law and legal theory

– I. Wallerstein, “The rise and future demise of the capitalist world system: concepts for comparative analysis“, I. Wallerstein, The capitalist world-economy. Cambridge University Press, Cambridge, 1980. pp. 5-6, 17-19, 34; The modern world-system, I; Capitalist agriculture and the origins of the European world-economy in the sixteenth century, Academic Press, New York, San Francisco, London, 1974

– Reuven Avi-Yonah, “International tax as international law“, New York Tax Law Review, Vol. 57, 2003-2004, at 483

– Pasquale Pistone, “Coordinating the action of regional and global players during the shift from bilateralism to multilateralism in international tax law”, World Tax Journal, Vol. 6, February 2014

The rationale for a financial transaction tax

Since the autumn of 2008, the apparent start of a global financial crisis, a shift in emphasis can be experienced worldwide in the taxation policy applicable to the financial sector from neutrality to correction. It has been required to bail out financial enterprises and introduce regulatory and tax measures to address the emerging crisis. Under these circumstances, it is not sufficient longer just to respect, or even expedite, the free movement of capital and enterprises. The false presupposition must be thrown away that markets tend to equilibrium, and departure from it is at random only.

The most appropriate measure for the direct reimbursement of the public for the cost of bail outs, and for the squeeze of the financial activity that bears systemic risks, seems to be a claw back one, a model of which is the Dodd-Frank Bill of 22 July 2010. The backside of this measure is, however, that “ex post” measures weaken the credibility of the public regulator, deteriorating the investment climate. An obvious alternative to an “ex post” measure is an “ex ante” one, modelled on the concept of the financial stability contribution (“FSC”) as appears in the IMF report prepared for the G-20 of June 2010. This is largely tantamount to a bank levy that applies to the risky portfolio of either banking liabilities or risk-weighted banking assets. A well-designed bank levy seems targeted enough, it does not yet threaten the normative basis of public intervention significantly.

Concerning a broad scope of taxation, a financial transaction tax (“FTT”) seems to be a very promising instrument of public intervention. Comparing to FSC, FTT seems yet to be a bold idea. FTT does not seem to be targeted enough, being levied on the gross value of transactions. It is easy to see from this that such a tax is likely fraught with distorting effects. Indeed, the literature is diligent in pointing out a series of problems. Some of them are: the cascading effect, the reducing effect of liquidity, and the failure to reduce short-term volatility in prices.

– Ross P. Buckley, Gill North, “A financial transactions tax: inefficient or needed systemic reform?”, Georgetown Journal of International Law, Vol. 3 (2011-2012), at 745

– Timothy A. Canova, “Financial market failure as a crisis in the rule of law: From market fundamentalism to a new Keynesian regulatory model”, Harvard Law & Policy Review, Vol. 3, at 369 (2009)

– Joseph E. Stiglitz, “The Commission of Experts of the President of the UN General Assembly on Reforms of the International Monetary and Financial System; Principles for a new financial architecture”, adopted by the General Assembly of the UN in 2009 (Stiglitz Commission Report), 21 September 2009, Sec. I.2.

– Gerard T.K. Meussen, “A new strategy for the European Union: FTT and FAT, realistic or a bridge too far?”, European Taxation, Vol. 51, February-March 2011

– Thorsten Vogel, Benjamin Cortez, “The Commission’s proposal to introduce an EU financial transaction tax”, European Taxation, Vol. 52, February-March 2012

– Christiana H.J.I. Panayi, “The EU’s financial transaction tax, enhanced cooperation and the UK’s challenge”, European Taxation, Vol. 53, August 2013

– Thornton Matheson, “Taxing financial transactions: Issues and evidence”, in: Stijn Claessens, Michael Keen, and Ceyla Pazarbasioglu (eds), Financial sector taxation: The IMF’s report to the G-20 and background material, International Monetary Fund, September 2010

– Patrick Honohan Sean Yoder, “Financial transactions tax panacea; Threat, or damp squib?”, Policy research working paper, No. 5230, The World Bank Development Research Group Finance and Private Sector Development Team, March 2010

– Stephan Schulmeister, Margit Schratzenstaller, Oliver Picek, A general financial transaction tax; Motives, revenues, feasibility and effects, WIFO, Vienna, March 2008

Environmental taxes in a world of the global ecological crisis and global poverty

The subject of a study paper can be, in general, the explanation and justification of environmental taxes that appear in the EU in the light of the current ecological crisis. In particular, a study paper can assess European developments and examine the practice of the EU Court of Justice, pursued in this field. It should then turn out that environmental tax legislation of the Member States may get stuck due to the EU Court that is committed to the fundamental freedoms. Such a failure may happen because the Member State’s environmental taxes are not targeted enough or they establish the special treatment of a group of taxpayers that cannot be upheld before EUCJ in the light of the non-discrimination principle.

Admittedly, the micro- and macroeconomic approaches that are predominantly determined by market considerations may constitute obstacles to an effective environmental policy. It is the idea of seeking for cases of Pareto-efficiency that lies behind the micro-approach. It is based on the theoretical assumption of the perfection of market bargains. However, ecological problems can hardly be understood by merely referring to the underlying rationality of profit maximisation to be achieved in a market economy. It is in turn the hypothesis of idealising self-regulating markets that stands behind the macro approach. From this point of view, the removal of barriers to the free movement of capital and labour can be considered as a common good. Such an approach can only be able to address ecological problems to a limited extent.

– Christian Joerges, Christian Kreuder-Sonnen, ”Europe and European studies in crisis: Inter-disciplinary and intra-disciplinary schisms in legal and political science“; Discussion Paper, SP IV 2016– 109, Wissenschaftszentrum Berlin für Sozialforschung, Berlin, 2016

– Janet E. Milne, Mikael Skou Andersen, ”Introduction to environmental taxation concepts and research“, Janet E. Milne, Mikael Sou Andersen (eds), Handbook of research on environmental taxation, Edward Elgar, Cheltenham, 2012

– Edoardo Traversa, Sébastien Wolff, Energy tax policy in an EU context: ”Non-discrimination, free movement and tax harmonisation“, Pasquale Pistone, Marta Villar Ezcurra (eds), Energy taxation, environmental protection and state aids, IBFD, Amsterdam, 2016

– Elizabeth Gil Garcia, Maria Teresa Soler Roch, ”Environment and taxation: State intervention from a theoretical point of view“, Pasquale Pistone, Marta Villar Ezcurra (eds), Energy taxation, environmental protection and state aids, IBFD, Amsterdam, 2016

– Andrew Leicester, ”Environmental taxes: economic principles and the UK experience“, English translation of the chapter ‘Tributación medioambiental: principios económicos y experiencia en el Reino Unido’ published in E. Pelegry, M. Larrea Basterra (eds.), Energía y Tributación Ambiental, Orkestra, Basque Institute for Competitiveness, 2013, 31 p.

– David A. Weisbach, ”Should environmental taxes be precautionary?“, Institute for Law and Economics Working Paper, No. 601 (2d series), June 2012

– Hans Jonas: The Imperative of responsibility – In search of an ethics for the technological age, The University of Chicago Press, Chicago, 1984

– Paul Ekins, “Introduction to the issues and the book“; in: Paul Ekins, Stefan Speck, Environmental tax reform, Oxford University Press, Oxford, 2011, pp. 4-5

– Herman E. Daly ”From empty world to full world economics“; in Robert Goodland, Herman E. Daly, and Salah El Serafy (eds.), Population, technology and lifestyle: The transition to sustainability, Island Press, Washington, DC, 1992

– Nicolas Georgescu-Roegen, ”The entropy law and the economic process in retrospect“, Eastern Economic Journal, Vol. XII, No. 1 (January – March 1986)

– Peter G. Brown and Peter Timmerman, ”Introduction; The unfinished journey of ecological economics“; Peter G. Brown and Peter Timmerman (eds), Ecological economics for the anthropocene: An emerging paradigm, Columbia University Press, New York, Chichester, West Sussex, 2015

– Arthur C. Pigou, The Economics of welfare, Macmillan, London, 1932; “Part II, Chapter IX: Divergences between marginal social net product and marginal private net product”

– Pedro M. Herrera Molina, ”Design options and their rationales“, Janet E. Milne, Mikael Sou Andersen (eds), Handbook of research on environmental taxation, Edward Elgar, Cheltenham, 2012

– Anil Markandya, ”Environmental taxation: what have we learnt in the last 30 years?“; in: Laura Castellucci, Anil Markandya (eds), Environmental taxes and fiscal reform, Palgrave, Basingstoke, New York, NY, 2012

– Stefan Speck, Susanna Paleari, Environmental taxation and EU environmental policies; European Environment Agency Report No 17/2016, Publications Office of the European Union, Luxembourg, 2016

– Marta Villar Ezcurra, ”Energy taxation and state aid law“, in: Isabelle Richelle, Wolfgang Schön, Edoardo Traversa (eds.), State aid law and business taxation, Springer-Verlag, Berlin, Heidelberg, 2016

– Federica Pitrone, ”Design of energy taxes in the European Union: Looking for a higher level of environmental protection“, Pasquale Pistone, Marta Villar Ezcurra (eds), Energy taxation, environmental protection and state aids, IBFD, Amsterdam, 2016

– Phedon Nicolaides, ”In search of economically rational environmental state aid: the case of exemption from environmental taxes“, European Competition Journal, Vol. 10, No. 1 (April 2014)

– Phedon Nicolaides, Antonis Metaxas, »Asymmetric tax measures and EU state aid law; The “special solidarity levy” on Greek producers of electricity from renewable energy sources», European State Aid Law Quarterly, Vol. 13, Issue 1 (2014)

Péter GEDEON

· Political economy of the postsocialist transformation

· Political economy of the welfare state

József GOLOVICS

· Migration in the European Union. Emigration from Hungary.

Selected readings:

Massey, D. S., Arango, J., Hugo, G., Kouaouci, A., Pellegrino, A., & Taylor, E. J. (1993). Theories of International Migration: A Review and Appraisal. Population and Development Review, 19(3), 431-466.

Zaiceva, A., & Zimmermann, K. F. (2008). Scale, diversity, and determinants of labour migration in Europe. Oxford Review of Economic Policy, 24(3), 428–452.

· Applications of Institutional Economics

Selected readings:

North, D. C. (1990). Institutions, Institutional Change and Economic Performance. Cambridge: Cambridge University Press.

Williamson, O. E. (1985). The Economic Institutions of Capitalism. Firms, Markets, Relational Contracting. New York: The Free Press.

Dóra GYŐRFFY

· The political economy of financial crises

After the 2008 subprime crisis the problem of financial crisis became a central issue in economic policy not only in the developing world but also in advanced economies. Although the crises evolve in the financial sphere, their roots are often in the political or the social sphere – for example increasing indebtedness is an often applied method to mitigate the dissatisfaction of the population or gain popularity prior to elections. The management of financial crises and the distribution of the burden of adjustment are also deeply political questions. The research analyzes the interactions between the financial and political spheres in order to answer questions about the origins and management of financial crises. Understanding the interactions between politics and finance is indispensable to develop institutions, which are able to prevent future crises or at least reduce their probability. Given the nature of the subject, an interdisciplinary methodology is necessary for research with a specific emphasis on case studies.

Selected literature:

Brunnermeier, Markus K., Harold James and Jean-Pierre Landau (2016): The Euro and the Battle of Ideas. Princeton and Oxford: Princeton University Press.

Kindleberger, Charles P. and Robert Z. Aliber (2005): Manias, Panics and Crashes: A History of Financial Crises. Fifth edition. Hobokan, New Jersey: John Wiley and Sons.

Reinhart, Carmen M. and Kenneth S. Rogoff (2009): This Time is Different: Eight Centuries of Financial Folly. Princeton: Princeton University Press.

Sinn, Hans-Werner (2014): The Euro Trap: On Bursting Bubbles, Budgets and Beliefs. Oxford: Oxford University Press.

Shiller, Robert J. (2000): Irrational Exuberance. Princeton, NJ: Princeton University Press.

Balázs HÁMORI:

· New developments in the Behavioral Economics

Selected readings:

Daniel Kahneman: Thinking, Fast and Slow, Penguin Books Ltd (UK), 2012

Matthew Rabin: “Incorporating Limited Rationality into Economics”, Journal of Economic Literature, 51(2): 528-43, June 2013.

Matthew Rabin: “An Approach to Incorporating Psychology into Economics”, American Economic Review, 103(3): 617-22, May 2013

Tibor Scitovsky: (1976), The joyless economy: an inquiry into human satisfaction and consumer dissatisfaction, Oxford University Press, 1976 pages.ucsd.edu/~nchristenfeld/Happiness_Readings_files/Class%206%20-%20Scitovsky%201976.pdf

Herbert A.Simon: Models of Bounded Rationality, Volume 2 & 3, The MIT Press, 1984 and 1987.

Arrow, Kenneth, “Rationality of Self and Others in an Economic System,” in Hogarth and Reder, (eds.) Rational Choice (1987).

Dan Ariely: Predictably Irrational – The Hidden Forces That Shape Our Decisions Revised and Expanded Edition, Harper Perennial, April 2010

· How have economic decisions been influenced by human emotions — Az érzelmek hatása a gazdasági döntésekre

Selected readings:

Amos N. Tversky és Daniel Kahneman: Choices, Values, and Frames, 2000

Th Gilovich, D Griffin, D Kahneman (eds): Heuristics and Biases: The Psychology of Intuitive Judgment

Mérő László: Habits of Mind: The Power and Limits of Rational Thought Hardcover, 2002

Mihály Csíkszentmihályi: Flow: the psychology of optimal experience, Harper.Collins, 1990

Mihály Csíkszentmihályi: Flow: The Psychology of Happiness: he Classic Work on How to Achieve Happiness 2002

Rick, Scott and Loewenstein, George F. (2007): The Role of Emotion in Economic Behavior (January 3, 2007). Available at SSRN: ssrn.com/abstract=954862

Berezin, M.: Emotions and the ecomomy: Center for the Study of Economy and Society Working Paper Series #12, Cornell University Department of Sociology, 2003.

· Comparison of economic system versions in the light of the crisis

Selected readings:

Steven Rosefielde: Comparative Economic Systems: Culture, Wealth, and Power in the 21st Century, Wileey, 2002, 1 – 304. old.

Csaba László: On The Future Of Transition /Studies/. In: Kolodko GW, Tomkiewicz J, editors. Twenty Years of Transition: Achievements, Problems and Perspectives. New York: Nova Science; 2016. p. 221-35..

Csaba László. Economic Systems: Constraints and Driving Forces Of Change. In: Balázs H, M. R, editors. Constraints and Driving Forces in Economic Systems. Newcastle-upon-Tyne/UK: Cambridge Scholars Publishing; 2015.

Heitger, B.: Property rights and the wealth of nations: a cross-country study. CATO Journal, 23. évf. 2oo4, 2. szám, 381-4o2. old.

János Kornai: Dynamism, Rivalry and the Surplus Economy: Two Essays on the Nature of Capitalism. Oxford: Oxford University Press, 2013. (Translated by Brian McLean.) Original in Hungarian: 2011.

János Kornai: From Socialism to Capitalism. Budapest: Central European University Press. 2008. (Translated by Brian McLean.) Original in Hungarian: 2007.

· The role of the institutions in the functioning of the economy

Selected readings:

János Kornai, László Mátyás and Gérard Roland (eds):.Corruption, Development and Institutional Design. New York: Palgrave Macmillan in association with the International Economic Association, 2009. Available here.

János Kornai, László Mátyás and Gérard Roland (eds.): Institutional Change and Economic Behaviour. New York: Palgrave Macmillan in association with the International Economic Association, 2008. Available here.

Korpi, Walter, Contentious Institutions. An Augmented Rational-action Analysis On the Origins and Path Dependency of Welfare State Institutions in Western Countries. Rationality and Society, 2001, Vol. 13, No. 2, pp. 235–283

Kosals, L.: Essay on clan capitalism in Russia. Acta Oeconomica, 57. évf. 2oo7, 1. sz 67-87. o.

Hayek, Friedrich A. von, The Meaning of Competition. In: Hayek, Friedrich A. von, Individualism and economic order. Routledge & Kegan Paul, London and Henley, 19491, 1976, pp. 92-106

Kirzner, Israel M., Entrepreneurial Discovery and the Competitive Market Process. Journal of Economic Literature, Vol. 35, Issue 1, March 1997, pp. 60-85

Smyth, Russell, New Institutional Economics in the Post-Socialist Transformation Debate. Journal of Economic Surveys, Vol. 12, No. 4, September 1998, pp. 361-398

· Information Economy/Knowledge Economy

Selected readings:

Brian Kahin and Dominique Foray (eds.): Advancing Knowledge and The Knowledge Economy, The MIT Press, 2006.

Robert Hassan: The Information Society, Polity Press, Cambridge, UK, 2008.

Carl Shapiro – Hal R. Varian: Information Rules – A strategic Guide to the Network Economy. Harvard Business Publishing, 1998

Walter W. Powell and Kaisa Snellman: The Knowledge Economy, Annu. Rev. Sociol. 2004. 30:199–220

Gergő MEDVE-BÁLINT:

· The political economy of regional development/regional disparities in Eastern Europe

· Foreign Direct Investment, investment promotion and state aid in the EU

· EU Cohesion Policy

Miklós ROSTA:· New Public Management and Post-New Public Management

· Centralization and soft budget constraint

· Coproduction and cooperative governance

· Illiberal states in CEE

András SZÉKELY-DOBY· The political economy of Chinese transformation

Selected readings:

Brandt, L. & T. G. Rawski: China’s Great Economic Transformation. Cambridge University Press. Cambridge, 2008.

Fan, J., R. Morck & B. Yeung: Capitalizing China, NBER Working Paper No. 17687. December, 2011.

Naughton, B.: The Chinese Economy. Transitions and Growth. MIT Press, Cambridge, 2007.

Pei, M.: China’s Trapped Transition. The Limits of Developmental Autocracy. Harvard University Press, Cambridge, 2006.

Shambaugh, D.: China’s Future. Polity Press, Cambridge, 2016.

· The developmental state in East Asia

Selected readings:

Amsden A.: The Rise of ‘the Rest’: Challenges to the West from Late-Industrializing Economies. Oxford University Press, Oxford, 2001.

Gerschenkron, A.: “Economic Backwardness in Historical Perspective”, In: Granovetter M. & Svedberg, R. (eds): The Sociology of Economic Life. Westview Press, Boulder, 1992/1951, pp. 111-130.

Johnson, C.: MITI and the Japanese Miracle: The Growth of Industrial Policy. 1925-1975. Stanford University Press, Stanford, 1982.

Knight, J. B.: “China as a Developmental State”, The World Economy, vol. 37(10), October, 2014.

Wade, R.: Governing the Market. Economic Theory and the role of Government in East Asian Industrialization. Princeton University Press, Princeton, 1990.

· Relevant problems of economic development in India

Selected readings:

Bardhan, P.: Awakening giants, feet of clay. Assessing the economic rise of China and India. Princeton University Press, Princeton, 2010.

Chai, J. C. H. & K. C. Roy: Economic Reform in China and India. Development Experience in a Comparative Perspective. Edward Elgar Publishing, Northampton, 2006.

Hope, N. C., A. Kochar, R. Noll & T. N. Srinivasan: Economic Reform in India. Challenges, Prospects, and Lessons. Cambridge University Press, Cambridge, 2013.

Kumar, D.: Information Technology and Social Change. Rawat, New Delhi, 2006.

Panagariya, A.: India: The Emerging Giant. Oxford University Press, New York, 2008.

· Institutions and economic development: political economic models

Selected readings:

Acemoglu, D. & J. A. Robinson: Economic Origins of Dictatorship and Democracy. Cambridge University Press, Cambridge, 2006.

Acemoglu, D., & J. A. Robinson: Why Nations Fail: The Origins of Power, Prosperity, and Poverty. Crown Publishers, New York, 2012.

Hellman, J. S.: “Winners Take All: The Politics of Partial Reform in Postcommunist Transitions.” World Politics, Vol. 50, No. 2, 1998, pp. 203-234.

North, D. C., J. J. Wallis & B. R. Weingast: Violence and Social Orders. A Conceptual Framework for Interpreting Recorded Human History. Cambridge University Press, Cambridge, 2009.

Przeworski, A.: Democracy and the market: political and economic reforms in Eastern Europe and Latin America. Cambridge University Press, Cambridge, 1991.

Pál VERES:

· Higher Education Funding and Governance

Aim of the course: 1) Creating models of Higher Education as subsystem of educational system and the society. 2) Presenting and analysing alternative models of funding and governance on system level. 3) Presenting and analysing the role of institutions reflecting to the national and international (global) challenges.

Method of the course: 1) Teacher’s presentations on the main theories of the topic of the course. 2) Presenting of the selected readings by the students. 3) Common and group discussion of the presentations 4) Developing and presenting research plan by the students.

Selected readings:

Barr, N. (1992)]: Economic Theory and the Welfare State: A Survey and Interpretation.. Journal of Economic Literature, 30. (June) pp. 741-803.

http://eds.a.ebscohost.com/eds/pdfviewer/pdfviewer?vid=3&sid=f43316f8-702c-405b-8b8e-a62a2f660675%40sessionmgr4010 (Download: 2017.06.27.)

Barr, N. (2004): Higher education funding. Oxford Review of Economic Policy, 20(2), pp. 264-83, http://eds.b.ebscohost.com/eds/pdfviewer/pdfviewer?vid=1&sid=bec028c7-5d29-4db3-84af-c9159c1f328f%40sessionmgr101 (Download: 2017.06.27.)

OECD (2016): Education at a glance 2016. OECD indicators. OECD http://www.oecd-ilibrary.org/docserver/download/9616041e.pdf?expires=1498553155&id=id&accname=guest&checksum=91945790ADF31EB239C043D09D51B067 (Download: 2017. 06. 27.)

European Commission (2011): Modernisation of Higher Education in Europe: Funding and Social Dimension, Education, Audiovisual and Culture Executive Agency (EACEA P9 Eurydice). eacea.ec.europa.eu/education/eurydice/documents/thematic_reports/131EN.pdf (Download: 2017.06.27.)

Middleton, C. (2000): Models of State and Market in the ‘Modernisation’ of Higher Education, British Journal of Sociology of Education, 21(4).pp. 537-554. http://www.jstor.org/stable/pdf/1393381.pdf?refreqid=excelsior%3Adb55f573fcdeaf37606db0bde6ea396f (Download: 2017.06.27.)

CHOWDRY, H.-DEARDEN, L.- GOODMAN, L. – JIN, W. (2012) The Distributional Impact of the 2012–13 Higher Education Funding Reforms in England, Fiscal Studies,33 (2) http://onlinelibrary.wiley.com/doi/10.1111/j.1475-5890.2012.00159.x/pdf (Download: 2012. 11.19.)

Ferlie, F.- Musselin, C., – G Andresani, G (2008): The steering of higher education systems. A public management perspective. Higher education, 56(április 17). pp, 325-348.

http://eds.a.ebscohost.com/eds/pdfviewer/pdfviewer?vid=0&sid=df0f6ccf-695b-4bdf-a356-2b24b8da30b8%40sessionmgr4008 (Download: 2017.06.27.)

European Comission, Education and Culture DG (2008): Higher Education

Governance in Europe – Policies, structures, funding and academic staff http://eacea.ec.europa.eu/education/eurydice/documents/thematic_reports/091EN.pdf (Download: 2017.06.27.)

HECKMAN, J. J. – LOCHNER, L. – TABER, C. (2012): Human Capital Formation and General Equilibrium Treatment Effects: A Study of Tax and Tuition Policy, Fiscal Studies, 20(1) pp. 25–40 (http://onlinelibrary.wiley.com/doi/10.1111/j.1475-5890.1999.tb00002.x/pdf (Download: 2012. 11. 19.)

DEARDEN, L. –GOODMAN, A. –WYNESS, G. (2012): Higher Education Finance in the UK, FISCAL STUDIES, 33(1) pp. 73–105 http://onlinelibrary.wiley.com/doi/10.1111/j.1475-5890.2012.00153.x/pdf (Download: 2012. 11. 19.)

Creedy, J. (2012): Financing Higher Education: Public Choice and Social Welfare, Fiscal Studies,15(3), pp.87-108 (http://onlinelibrary.wiley.com/doi/10.1111/j.1475-5890.1994.tb00205.x/pdf (Download: 2012. 11. 19.)

Schindler, D. (2011): Tuition Fees and Dual Income Tax: The Optimality of the Nordic Income Tax System. German Economic Review 12(1):59-84.o. http://onlinelibrary.wiley.com/doi/10.1111/j.1468-0475.2010.00504.x/pdf (Download: 2017.06.27.)

Vossensteyn, H. (2004): Fiscal Stress: Worldwide Trends In Higher Education Finance. In: NASFAA Journal of Financial Aid. 34(1) pp. 39-55. http://www.nyu.edu/classes/jepsen/nasfaa2004-01-01.pdf (Download: 2017.06.27.)

Krueger, A. B. – Lindahl, M. (2001): Education for Growth: Why and for Whom? Journal of Economic Literature, Vol. 39, December, pp. 1101-1136 http://www.unibg.it/dati/corsi/91015/49249-JEL%202000_kruegerlindahl.pdf. (Download): 2012.12.07.