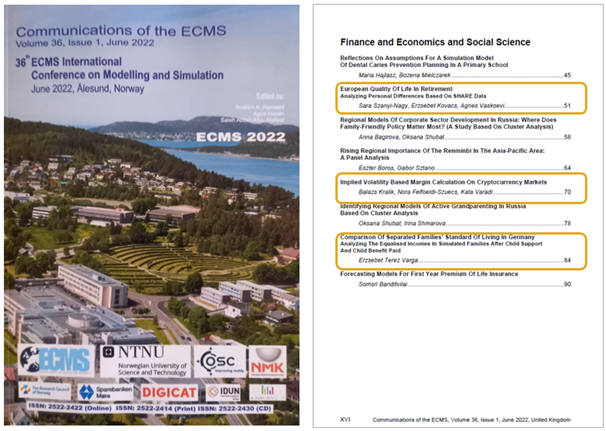

The 36th International ECMS Conference on Modelling and Simulation

The 36th International ECMS Conference on Modelling and Simulation was conducted from 31 May to 3 June 2022 in Ålesund, Norway, with the participation of 4 colleagues from 2 institutes at Corvinus University. The conference was organized by the European Council for Modelling and Simulation, an international organization that has created a truly interdisciplinary (informatics, engineering, economics etc.) workshop for several European researchers. The participants' work is linked by the applied methodology - modelling and simulation.

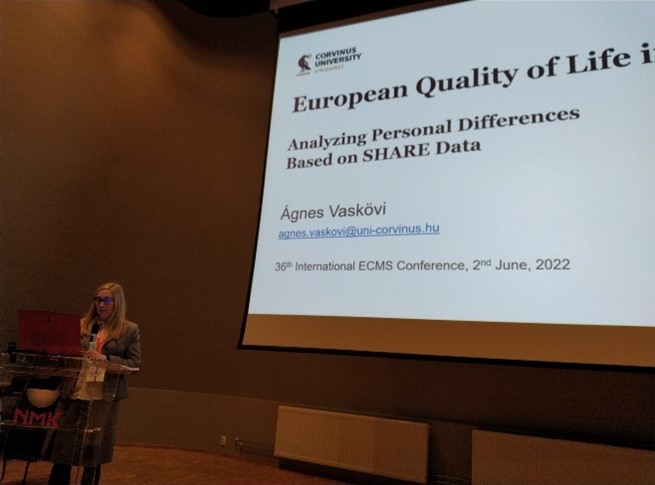

The conference series is of outstanding importance in the life of BCE two main aspects. On the one hand, the Finance, Economics and Social Sciences (FES) section of the conference has been organized and managed for years by staff from the Institute of Finance, Accounting and Economic Law at Corvinus University. In 2022, Kata Váradi is the chair of the International Program Committee (IPC) of the Section, and Ágnes Vaskövi is a member of the IPC. On the other hand, in 2017, Corvinus University of Budapest hosted the 31st ECMS conference, that was co-organized by BCE and BME.

This year’s conference was hybrid, with most of the speakers in person, but some attended online. Besides three plenary lectures, participants followed 45 scientific lectures in parallel sections based on the common methodology of modelling and simulation. For example, the clustering methodology was used in the DIS (Modelling and Simulation of Data Intensive Systems) section to distinguish between web bots and human users, but the same methodology was used in the FES section by two speakers on the analysis of Russian demographic trends.

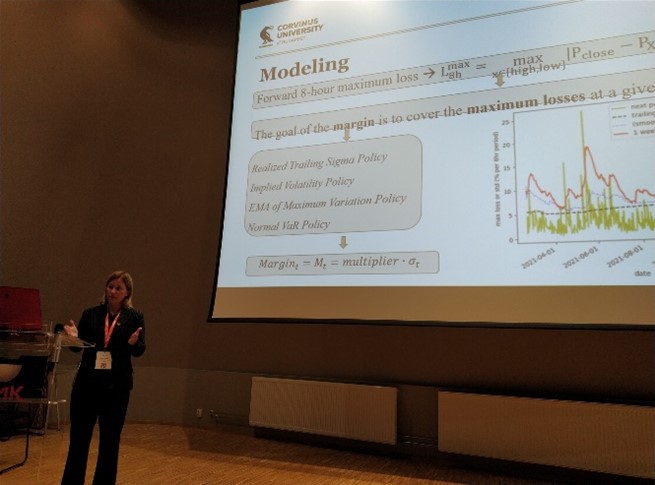

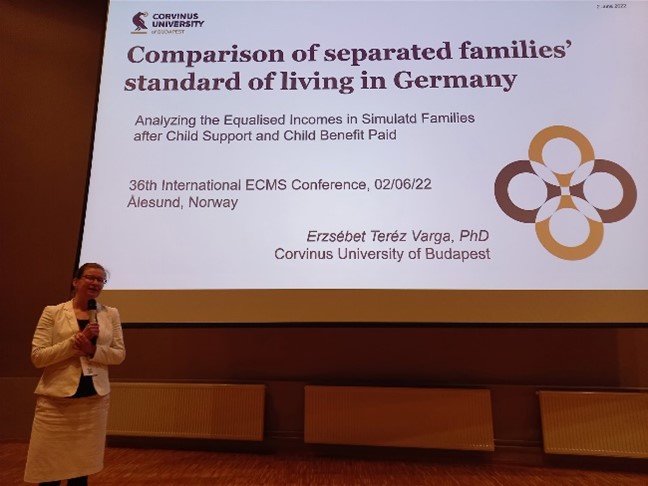

The conference was attended by four Corvinus university colleagues, all of us presented our ongoing research in the FES section. In her co-authoring study, Kata Váradi (Implied Volatility Based Margin Calculation on Cryptocurrency Markets) pointed out that in the derivatives market for cryptocurrencies, implied volatility is a better measure of margin calculation than historical standard deviation. In her study Comparison of Separated Families ’Standard of Living in Germany, Erzsébet Varga simulated the equalized standard of living for divorced parents and their children using German data. In her joint research with Erzsébet Kovács and Sára Szanyi-Nagy (European Quality of Life in Retirement – Analyzing Personal Differences Based on SHARE Data), Ágnes Vaskövi analyzed some aspects of the life quality of European retirees using multivariate statistical methods.

We received valuable questions from the participants of the conference, along which our research can be further developed, and personal participation also enabled us to establish relationships with international researcher colleagues. The conference proceedings includes our papers, which could be extended to research publications.