Kent Matthews on Shadow Banking in China

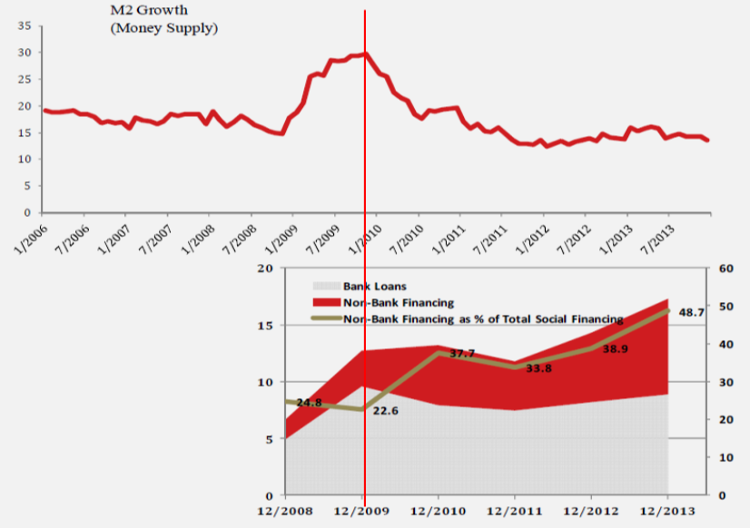

Update on ESRC-NSFC ProjectKent Matthews, a researcher at the University of Cardiff, visited the Institute of Economics on 9th February 2022. At the lunchtime research seminar for a packed room of colleagues, he introduced us to his recent research project about how the shadow banking system of China has evolved and what implications the system’s current regulation can make on the growth of the Chinese economy. The presentation started with the role of Shadow Banking in China and how its growth influences growth. There is a vivid discussion of whether shadow banking helps or hinders provincial economic growth. The modeling exercise applies DSGE methods and shows that the shadow banking system contributes to growth by providing extra resources to the Chinese SMEs even when the “normal” banking system refuses to do so due to the higher risk associated with SMEs. The research project involves several UK and Chinese universities working in cooperation, among which Cardiff University and Fudan University lead the research on Shadow Banking in China.

The afternoon was spent by a lecture provided for Ph.D. students under the title of “Banks and SME Financing: Does Distance Matter?”. About fifteen Ph.D. students attended the lecture, most of them participated very actively in it. After the class, both Kent and the students spoke of an intensive, interactive, thought-provoking event that was very much worth attending.

Thanks to the Research Management Office for the support without which this event could not have been organized.